But, more importantly, life insurance can assist in protecting against life’s uncertainties. It could happen today, tomorrow, or in 50 years, but it will happen sooner or later. We have no way of knowing when we will die. A joint policy is usually less expensive than purchasing two separate policies, but in most cases, it only pays out once if you make a claim, you are no longer covered the surviving partner would then need to purchase their own individual policy. You can get a single policy, which only covers you, or a joint policy, which covers everyone in your household. Life insurance allows you to make financial contributions to your partner’s well-being after you’ve passed away, which is a lovely way to honor your marriage vows. If you’ve recently gotten engaged or married and are joining families and assets, knowing you’re both covered if one of you dies can make life easier. Because of the emotional strain they already face, you don’t want your spouse, your parents, or your children to be charged with additional financial liabilities. Funeral and burial costs, which can easily reach the tens of thousands of dollars, are other expenses. Your family needs insurance to cover any outstanding debts, such as mortgages, credit cards, and car loans, in addition to providing income to cover daily living expenses. If you choose an investment-linked policy, make sure to read the fine print to fully understand the risks and rewards. Some insurance policies are linked to specific investment products that pay out dividends based on how well they perform.

It also gives you a variety of investment options that are associated with various types of policies. It would help you in achieving long-term goals such as purchasing a home or planning your retirement because it is an instrument that keeps you invested for the long term. If you were to die, your spouse would be responsible for paying for the services you provide in trying to care for your family. Also, if you are a stay-at-home parent, keep in mind that the value you provide through your work with your children and at home is significant. These expenses may be covered by the death benefit from your life insurance policy. Your family might not be able to pay the mortgage or cover tuition costs without your income. This is especially important if you’re married with children and you’re the sole breadwinner. One of the most common reasons people purchase life insurance is to ensure that their loved ones are not financially challenged if they pass away unexpectedly. Here are a few more reasons why you should have life insurance. Plus, knowing that money will be available to protect your loved ones in the event of your death will give you peace of mind over time. Life insurance can be inexpensive depending on the type of policy you choose, so there’s no reason to wait.

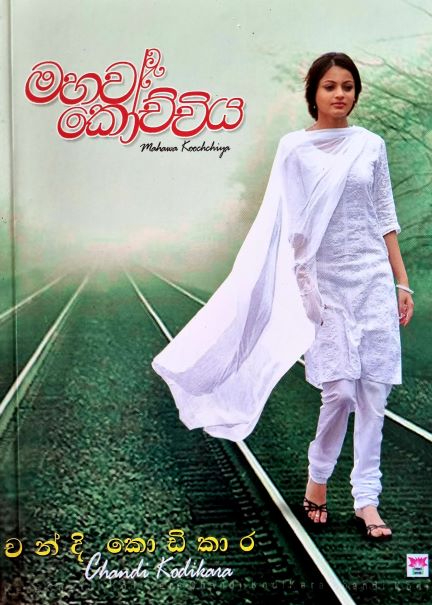

Sinhala novels download chandi kodikara free#

Your beneficiaries are free to use the funds for whatever they want. The insurance company will pay your beneficiaries a lump sum known as a death benefit after you die in exchange for your premium payments. When your family’s resources are limited, this term insurance will help them maintain their standard of living.Ī contract between you and an insurance company is known as life insurance. Your individual life insurance kicks in when you leave your job and are no longer covered by your employer. It’s also used to pay off your mortgage and personal loans like a car loan. It helps to protect your family by allowing you to leave them an amount that is not required to pay when you die. For many people, one of the most crucial financial decisions is to purchase life insurance. Many people are aware of it but are unsure why they might require insurance. It’s not uncommon for people to be confused by their life insurance policies.

0 kommentar(er)

0 kommentar(er)